Many young adults often dismiss the idea of purchasing life insurance, thinking that it is not something they need to worry about until later in life. However, there are many reasons why investing in a no medical life insurance policy at a young age can be a smart choice.

Toc

Introduction of No Medical Life Insurance for Young Adults

Life insurance is a crucial financial tool that provides peace of mind and financial stability to your loved ones in case of an unfortunate event. While most people understand the importance of life insurance, young adults often overlook its significance.

Many individuals in their 20s or 30s may feel invincible and think that they do not need to invest in life insurance until much later in life. However, no medical life insurance policies are designed to cater to this exact mindset and provide affordable coverage without any hassle.

What is No Medical Life Insurance?

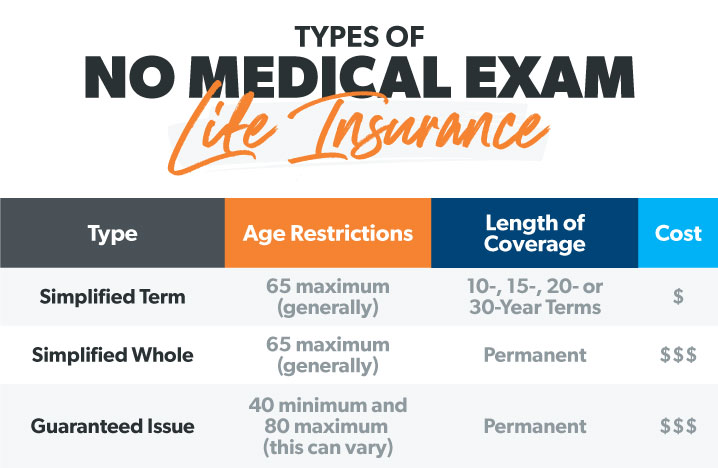

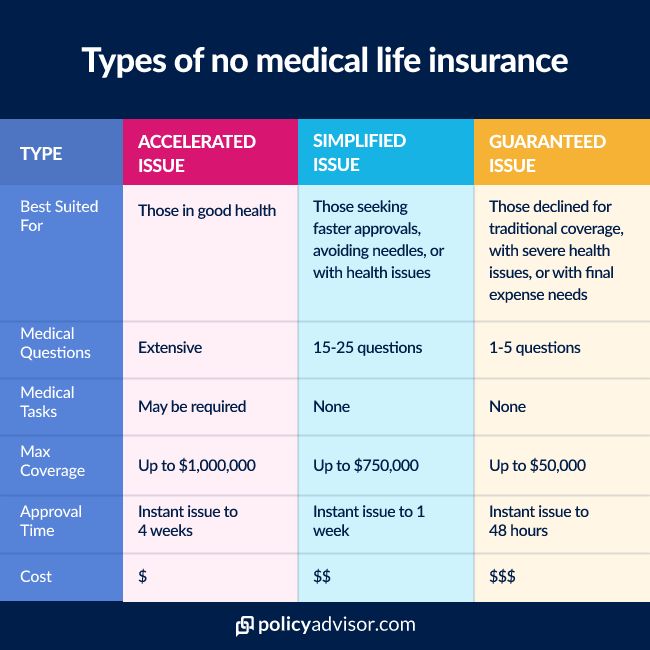

No medical life insurance, as the name suggests, allows individuals to obtain life insurance coverage without undergoing a medical examination. This type of policy is particularly appealing to young adults, as it removes the barriers and delays often associated with traditional life insurance policies. Typically, applicants only need to answer a few basic health questions, making the application process quick and straightforward.

Target Audience and Importance for Young Adults

The primary target audience for no medical life insurance policies includes young adults in their 20s and 30s who are beginning their careers, starting families, or even single individuals looking to build a secure financial future. This demographic often experiences significant life changes and milestones, such as purchasing their first home, getting married, or having children. These events increase the need for financial security and protection, making it imperative to consider life insurance sooner rather than later.

Understanding the importance of no medical life insurance for young adults extends beyond just the immediate benefits of convenience and cost. Securing life insurance at a young age locks in lower premium rates for the duration of the policy and ensures that coverage is in place before any potential health issues arise. Additionally, in the unfortunate event of an untimely death, the policy benefits can support loved ones by covering debts, funeral costs, and daily living expenses, preventing financial strain during an already difficult time.

The Benefits of No Medical Life Insurance for Young Adults

Peace of Mind and Financial Security

One of the paramount benefits of no medical life insurance for young adults is the peace of mind it provides. Knowing that your loved ones are financially protected in the event of your sudden passing can relieve a significant burden. This sense of security allows you to focus on your personal and professional growth without the looming worry of leaving your dependents in financial turmoil.

Opportunity for Investment

No medical life insurance policies often offer more than just death benefits. Some types of policies, particularly whole life or universal life insurance, accumulate cash value over time. This means that part of the premium you pay builds up as a cash reserve, which you can borrow against or withdraw under specific conditions. Starting such a policy at a young age allows for more time for this cash value to grow, providing a potential financial resource for future needs—be it an emergency fund, investment opportunities, or retirement planning.

Flexibility and Customization

Another advantage is the flexibility and customization options available with no medical life insurance. Many insurers offer various riders that can be added to the basic policy, tailoring the coverage to meet your unique needs. For example, you might add a critical illness rider, which provides a payout if you are diagnosed with a serious health condition. This flexibility ensures that your life insurance policy can adapt as your life circumstances change, providing continued security and relevance throughout different stages of your life.

Quick and Easy Application Process

One of the standout features of no medical life insurance is its quick and easy application process. Often completed online, it allows applicants to secure coverage without the hassle of scheduling medical exams or waiting for lengthy underwriting procedures. This means you can get insured in a matter of days, or even hours.

Who Should Consider No Medical Life Insurance?

While no medical life insurance policies are a great option for young adults, they may not be suitable for everyone. Those with pre-existing health conditions or a high-risk lifestyle may find that traditional life insurance policies offer better coverage and rates. However, it is always worth exploring all options and speaking to an insurance professional to determine the best fit for your individual circumstances.

Young Adults and Financial Planning

Financial planning is a pivotal aspect of adulthood that should begin as early as possible, and life insurance is a key component of a comprehensive financial strategy. For young adults, incorporating no medical life insurance into their financial plan can offer significant advantages. By securing a policy early, individuals can take advantage of lower premiums and build a financial cushion that can aid in long-term planning.

When considering financial planning, young adults should assess their overall financial goals alongside their existing commitments. This includes budgeting for everyday expenses, paying down any student loans or other debts, and saving for future milestones like purchasing a home or starting a family. No medical life insurance can play a supportive role in this process by ensuring that financial obligations are met regardless of unforeseen circumstances.

Additionally, young adults are often in the early stages of their careers and may not have accumulated substantial savings. In the event of an untimely death, life insurance can provide immediate financial relief to beneficiaries, covering costs such as rent or mortgage payments, car loans, and other day-to-day expenses. This ensures that loved ones are not left grappling with financial uncertainties during an emotionally challenging period.

By integrating no medical life insurance into a broader financial plan, young adults can achieve a balanced approach to managing their finances, ensuring both present needs and future security are addressed. This proactive measure fosters a sense of control and confidence as they navigate the various stages of their financial journey.

Individuals without Traditional Life Insurance Options

For individuals who may not qualify for traditional life insurance due to health concerns or other factors, no medical life insurance serves as a crucial alternative. These policies do not require medical exams, making them accessible to those with pre-existing conditions who might otherwise face challenges obtaining coverage. While the premiums for no medical life insurance tend to be higher than those for traditional policies, the trade-off is the ability to secure coverage without the invasive and sometimes disqualifying underwriting processes associated with standard life insurance.

One key benefit for such individuals is the assurance that they will not be denied coverage based on their health history. This can provide significant peace of mind, knowing that despite any medical issues, they can still protect their loved ones financially. Additionally, the simplified and expedited application process means that coverage can be secured quickly, which is particularly important for those who may have urgent coverage needs.

Moreover, no medical life insurance can bridge a gap for those in transitional phases—whether between jobs, without employer-provided life insurance, or recently diagnosed with a health condition that could impact future insurability. By securing a policy now, these individuals can maintain some level of financial protection, ensuring that their dependents are not left vulnerable.

How to Choose the Right No Medical Life Insurance Policy

As with any insurance product, it is crucial to research and compare different options before selecting the right policy for your needs. When considering no medical life insurance, some key factors to keep in mind include:

Evaluating Coverage Needs

When evaluating your coverage needs, it is important to consider several aspects:

- Financial Obligations: Assess all your current and future financial responsibilities. This includes outstanding debts like mortgages, car loans, or credit card balances, as well as ongoing expenses such as utility bills, education costs, and daily living expenses. Your life insurance policy should provide enough coverage to ensure these obligations are met in your absence.

- Income Replacement: Consider how much income your dependents would require to maintain their current lifestyle if you were no longer around. This typically involves calculating your current annual income and determining how many years of income replacement you want the policy to cover.

- Future Financial Goals: Think about your long-term financial objectives. This might include saving for your children’s education, funding a spouse’s retirement, or ensuring your family can remain in the family home. Your life insurance coverage should align with these goals to offer comprehensive protection.

Comparing Insurance Providers

Once you have a clear understanding of your coverage needs, it is essential to compare policies from various insurance providers. Look for reputable insurers with strong financial ratings and positive customer reviews. Additionally, consider the following factors:

- Premium Costs: Ensure the premiums fit within your budget while still providing adequate coverage.

- Policy Terms and Conditions: Review the terms of each policy carefully, including any exclusions or limitations.

- Riders and Add-ons: Evaluate available riders and add-ons to customize your policy according to your unique needs.

Consultation with an Insurance Professional

Navigating the complexities of life insurance can be challenging. Consulting with an experienced insurance professional can provide valuable insights and guidance tailored to your specific situation. A professional can help you compare different policies, understand the fine print, and ultimately choose the best no medical life insurance policy to fit your individual needs.

By carefully evaluating your coverage requirements, comparing providers, and seeking professional advice, you can make an informed decision that ensures financial security for your loved ones.

Case Studies

Emily’s Story

Emily, a 25-year-old freelancer, found herself struggling with irregular income. She needed a life insurance policy that fit her unpredictable budget. With no medical life insurance, Emily secured a policy online that offered the flexibility and coverage she needed, giving her peace of mind.

Mike’s Experience

Mike, a 30-year-old with a pre-existing condition, was repeatedly declined by traditional life insurance providers. Through no medical life insurance, he found a policy that offered immediate coverage without the need for a medical exam, ensuring his family’s financial security.

Sarah’s Journey

Sarah, a 28-year-old entrepreneur with a hectic travel schedule, valued the quick application process of no medical life insurance. She was able to obtain coverage within days, guaranteeing her family’s financial protection no matter where her business took her.

Jason’s Decision

Jason, a 26-year-old recent graduate, chose a no medical life insurance policy because of its affordability and flexible coverage. With student loans and a new career on his plate, he found a policy tailored to his financial situation, providing him with a safety net as he planned for the future.

Expert Quotes

- “No medical life insurance is a game-changer for young adults seeking financial security. Its accessibility and affordability make it an attractive option for those starting their financial journey,” says Jane Doe, Certified Financial Planner.

- “The flexibility and immediate coverage of no medical life insurance mean that young adults can protect their loved ones without delay. It’s an important tool for building a secure future,” according to John Smith, Insurance Expert.

- “For many young adults, the traditional life insurance process can be daunting. No medical life insurance offers a simplified and accessible alternative that meets the evolving needs of this generation,” comments Alex Johnson, Financial Advisor.

Conclusion

No medical life insurance offers numerous advantages, from a quick and easy application process to immediate coverage and accessibility for those with pre-existing conditions. Its affordability and flexibility make it an ideal choice for young adults looking to secure their financial future.

Don’t wait to take this crucial step in your financial planning. Explore no medical life insurance options today and provide your loved ones with the protection they deserve.

Before making any decisions, consider consulting with a financial advisor or insurance expert. They can provide personalized guidance and help you choose the best policy for your unique situation.