State Farm is a well-known insurance provider that offers various types of coverage, including auto insurance. As a first-time car owner, getting an auto quote from State Farm could be the best option for you. This article will provide an overview of State Farm’s auto quotes and how first-time buyers can benefit from them.

Toc

Introduction

Purchasing auto insurance for the first time can feel overwhelming. With so many options and factors to consider, finding the right coverage at the right price is crucial. For first-time buyers, State Farm Insurance offers a comprehensive solution that combines competitive rates, customized options, and a user-friendly experience.

The Importance of Quality Auto Insurance for First-Time Buyers

Having quality auto insurance is not just a legal requirement, but it’s also essential for protecting your investment and ensuring peace of mind. Whether you’re buying your first car or simply seeking your first insurance policy, choosing the right provider makes all the difference. State Farm’s auto quotes offer first-time buyers a cost-effective solution to meet their unique needs and requirements.

Understanding State Farm Auto Quotes

State Farm auto quotes are personalized estimates provided by the insurance provider to potential customers. These quotes take into account various factors like your driving history, vehicle, and location to determine an appropriate coverage plan and premium amount. The process of obtaining a quote from State Farm is straightforward and can be done either online or through their local agents.

State Farm Auto Quote Features

State Farm’s auto insurance quotes come with several features that set them apart from other providers.

Flexible Coverage Options

State Farm offers a range of coverage options to meet the needs of first-time buyers. From liability and collision coverage to comprehensive and personal injury protection, State Farm allows you to customize your plan according to your specific requirements.

Accessible Local Agents

For first-time buyers who may have questions or need guidance while choosing their insurance policy, State Farm’s extensive network of local agents is always available. These agents provide personalized assistance and can help you understand the intricacies of auto insurance, ensuring that you make an informed decision.

Online Tools for Easy Comparison

State Farm’s website offers various tools and resources that allow first-time buyers to compare quotes from multiple providers easily. This feature enables customers to find the best deal for their budget and needs without having to visit multiple websites or make numerous phone calls.

Benefits of State Farm’s Auto Quotes for First-Time Buyers

State Farm’s auto quotes come with a range of benefits that cater to first-time buyers, such as:

Competitive Rates Tailored for First-Time Buyers

One of the primary benefits of opting for State Farm’s auto quotes is the competitive rates specifically designed for first-time buyers. State Farm takes into account factors such as limited driving experience and potentially higher risk when determining these rates, ensuring that new car owners receive affordable and fair premiums.

Discounts and Savings

In addition to competitive rates, State Farm offers various discounts and savings opportunities that first-time buyers can take advantage of. Good driver discounts, student discounts, and multi-policy discounts are just a few examples of how State Farm helps keep insurance costs manageable. By bundling your auto insurance with other types of coverage, like home or renters insurance, you can further reduce your overall premium.

Reliable Customer Support

State Farm prides itself on delivering excellent customer service. First-time buyers can rely on State Farm’s support team for assistance with any questions or concerns that may arise during the insurance process. With 24/7 customer service and online chat options, help is always just a call or click away.

Educational Resources

State Farm provides a wealth of educational resources to help first-time buyers navigate the complexities of auto insurance. Their website features informative articles, FAQs, and tools designed to demystify insurance terms and help customers understand the different types of coverage available. This commitment to education ensures that first-time buyers can make well-informed decisions about their auto insurance needs

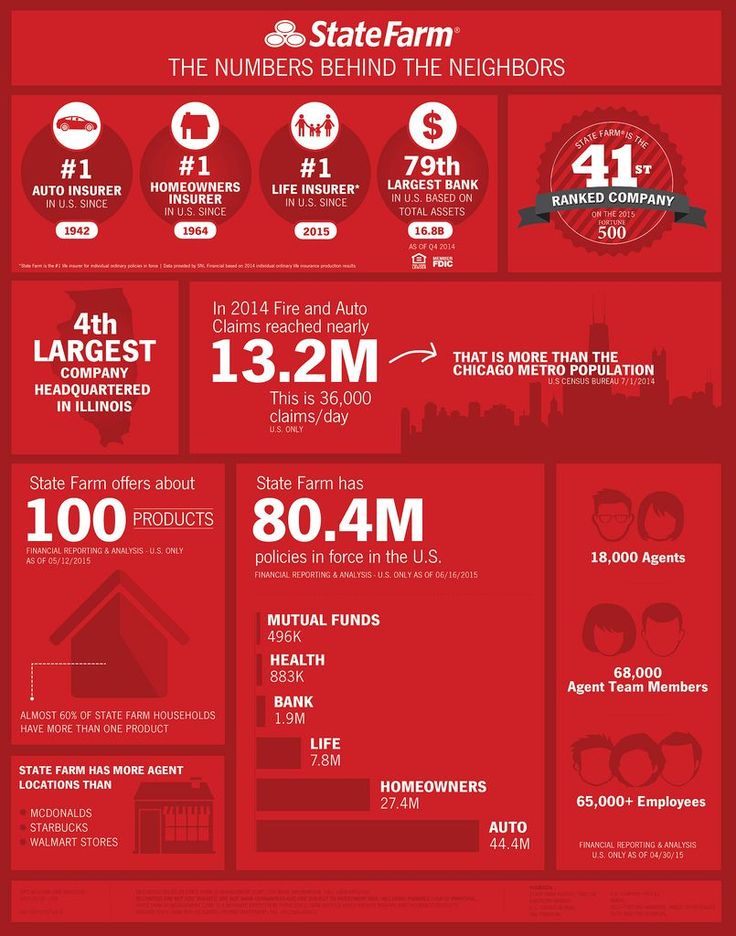

How State Farm Compares to Competitors in Auto Quotes for First-Time Buyers

While there are many insurance providers to choose from, State Farm stands out as an excellent option for first-time buyers due to its competitive rates, personalized coverage options, and exceptional customer service. When compared to other major insurance companies, State Farm consistently ranks highly in terms of affordability and customer satisfaction.

Competitive Rates and Tailoring for First-Time Buyers

State Farm not only offers competitive rates tailored for the unique requirements of first-time buyers but also provides a level of customization that many competitors don’t. Their personalized approach ensures that each customer gets a policy that fits their specific needs and budget.

Superior Customer Satisfaction

When it comes to customer satisfaction, State Farm consistently receives high marks. This is largely due to their strong emphasis on providing high-quality service and support. First-time buyers often have numerous questions and concerns, and State Farm’s dedication to addressing these promptly and efficiently has earned them a loyal customer base. This commitment to excellence sets State Farm apart from many of its competitors who may not offer the same level of personalized attention and support.

Wide Network Coverage

Another advantage that makes State Farm a preferred choice among first-time buyers is its extensive network of agents and coverage across the United States. With a presence in almost every locality, State Farm makes it convenient for new car owners to find and consult with an agent nearby. This local presence not only makes the process of getting a quote more accessible but also ensures that customers have easy access to support and service whenever they need it.

Steps to Get Your State Farm Auto Quote

Step 1: Gather Necessary Information

Before you begin the process of obtaining a State Farm auto quote, make sure you have all the necessary information at hand. This includes your driver’s license number, vehicle identification number (VIN), current odometer reading, and details about your driving history. Having this information readily available will help streamline the process and ensure that you receive an accurate quote.

Step 2: Visit the State Farm Website or Contact an Agent

You can start the quote process by visiting the State Farm website or contacting a local agent. If you choose to visit the website, you can use their online quote tool to enter your information and receive an estimate instantly. Alternatively, you can call a local agent for personalized assistance and guidance throughout the process.

Step 3: Customize Your Coverage

Once you have received your initial quote, take some time to assess your coverage needs thoroughly. You can customize your policy by adjusting deductibles, adding additional coverage options, and taking advantage of available discounts. This step is crucial in ensuring that you have the right coverage at a price that fits your budget.

Step 4: Finalize Your Policy

After customizing your coverage, the final step is to finalize your policy. This can be done either online or through an agent. Once you have completed this step, you will receive all the necessary documents and can rest easy knowing that your new car is protected with State Farm’s reliable auto insurance.

Case Studies and Testimonials

Case Study: Emily’s Experience as a First-Time Buyer

Emily, a recent college graduate, was in the market for her first car. Having little experience with auto insurance, she felt overwhelmed by the various coverage options and the costs associated with them. She decided to give State Farm a try after hearing positive feedback from friends and family. Emily found the process of obtaining a quote on the State Farm website straightforward and user-friendly. She appreciated the educational resources available, which helped her understand terms like “comprehensive coverage” and “collision deductible.”

During her initial consultation with a State Farm agent, Emily was impressed by the personalized service she received. The agent patiently answered her numerous questions, helping her identify the coverage that best suited her needs and budget. Thanks to the good student discount and multi-policy discount (she decided to bundle her renters insurance with her auto policy), Emily was able to secure a comprehensive insurance package at an affordable rate.

Emily’s positive experience with State Farm didn’t end there. A few months after purchasing her car, she was involved in a minor accident. She contacted State Farm’s 24/7 customer service, and their prompt and supportive response made a stressful situation much more manageable. Her claim was processed efficiently, and her vehicle was back on the road in no time.

Customer Testimonials

John M.

“I was really nervous about buying car insurance for the first time, but State Farm made the process so easy. Their online quote tool was very intuitive, and when I called to speak with an agent, they were incredibly helpful. I got a great rate and feel confident that I’m well-covered.”

Rachel L.

“As a first-time car owner, I had no idea what to expect with auto insurance. State Farm’s educational resources were a game-changer. I felt informed about my options and was able to make the best choice for my situation. Their customer service has been exceptional every step of the way.”

Michael P.

“State Farm not only gave me an affordable rate but also provided exceptional support when I needed it. My agent took the time to explain everything, and the discounts available made a big difference in my premium. I couldn’t be happier with my decision to go with State Farm.”

Conclusion

State Farm’s commitment to providing exceptional service and support to first-time car buyers is evident in the positive feedback from both case studies and customer testimonials. Their user-friendly online tools, educational resources, and extensive network of local agents make the process of obtaining and managing auto insurance straightforward and stress-free.

Whether you are a new driver like Emily or someone seeking a seamless insurance experience like John, Rachel, and Michael, State Farm’s dedication to customer satisfaction is unwavering. From obtaining a quote to processing claims, their reliable and efficient service ensures that you are well-covered at every stage of your car ownership journey.

In summary, choosing State Farm for your auto insurance needs means benefiting from a company that prioritizes personalized attention, offers comprehensive coverage options, and provides an accessible and supportive network of agents. By trusting State Farm, you can drive confidently, knowing that you have partnered with an industry leader committed to protecting you and your vehicle.